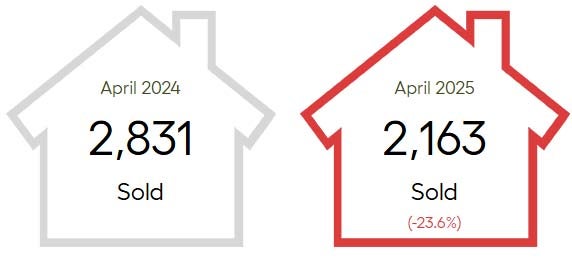

The real estate market in Metro Vancouver has slowed down quite a bit this spring. In April 2025, there were just over 2,100 homes sold — that’s about 24% fewer sales compared to April of last year. To put it in perspective, this year’s April sales were also nearly 30% below what we usually see for this time of year, based on the 10-year average.

“From a historical perspective, the slower sales we’re now seeing stand out as unusual, particularly against a backdrop of significantly improved borrowing conditions, which typically helps to boost sales,” said Andrew Lis, GVR’s director of economics and data analytics. “What’s also unusual is starting the year with Canada’s largest trading partner threatening to tilt our economy into recession via trade policy, while at the same time having Canadians head to the polls to elect a new federal government. These issues have been hard to ignore, and the April home sales figures suggest some buyers have continued to patiently wait out the storm.”

In April 2025, fewer than 6,900 homes were newly listed for sale in Metro Vancouver, which is a bit fewer than April of last year — down about 3%. However, it’s still much higher than what we usually see for this time of year — nearly 20% above the 10-year average.

Right now, there are over 16,200 homes available for sale across the region, which is almost 30% more than there were in April 2024, and nearly 50% above the long-term average. In short, buyers have a lot more options today than they did a year ago.

When we look at how quickly homes are selling, the sales-to-active listings ratio gives us a clue. In April, that ratio was 13.8% overall. Breaking it down by product type:

Detached homes: 9.9%

Townhomes (attached): 17.5%

Apartments: 15.7%

What does that mean? Historically, when this ratio drops below 12% for a while, prices tend to go down. If it stays above 20% for a few months, prices usually start to rise. Right now, we’re somewhere in the middle — suggesting a more balanced or slightly soft market, depending on the property type.

“While the headlines have been filled with worrying news lately, there are positives in the current market worth highlighting, especially for buyers,” Lis said. “Inventory levels have just crested 16,000 for the first time since 2014, prices have stayed fairly stable for the past few months, and borrowing costs are the lowest they’ve been in years. These factors benefit buyers, and with balanced conditions across the market overall, there’s plenty of opportunity for anyone looking to make a purchase.”

Home prices in Metro Vancouver have softened slightly this spring.

The typical (benchmark) home price across all property types is now $1,184,500, which is down 1.8% from last year and down 0.5% from last month.

Detached homes:

578 sold in April, down 29% from the same time last year. The typical detached home now costs $2,021,800, down 0.7% year-over-year and 0.6% from March.

Apartments:

1,130 sold in April, a 20% drop from last year. The benchmark price is now $762,800, down 2% from last year and 0.6% from the month before.

Townhomes (attached homes):

442 sold in April, down nearly 24% year-over-year. The benchmark price is $1,102,300, down 2.9% compared to last year and 1% from March.

The Takeaway:

Prices are down slightly across the board in all types, and fewer homes are selling compared to last year. This means more room for negotiation for buyers, and a need for smart pricing strategies if you're selling. The days of putting up a sign on the front lawn and getting multiple offers in the same weekend are over for sellers and buyers that are looking to get into the market… This is the window that you have been waiting for, we are getting into a buyer’s market; when you hear “I’m waiting for the market to improve”, that translates into “prices go up”.

If you would like to have to some real world advice about how to navigate the current market and plan for the future call or text me at 604-522-4777 or e-mail directly at: haze@hazerealtor.com or join us at our Facebook Page (www.facebook.com/HazeRealtor) and we see what the best move can be.